A new report from the European Securities and Markets Authority (ESMA) highlights a stark reality: the EU fund industry lags significantly behind the US in size, efficiency, and cost-effectiveness. The gap is real, and if Europe wants to boost private savings and make capital markets work for its citizens, something needs to change. Fast.

Let’s break it down:

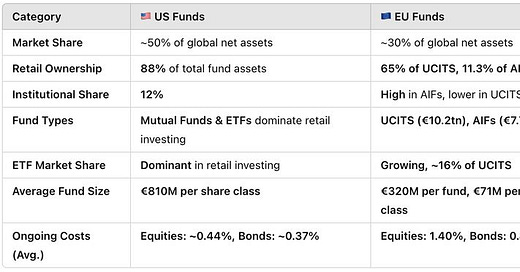

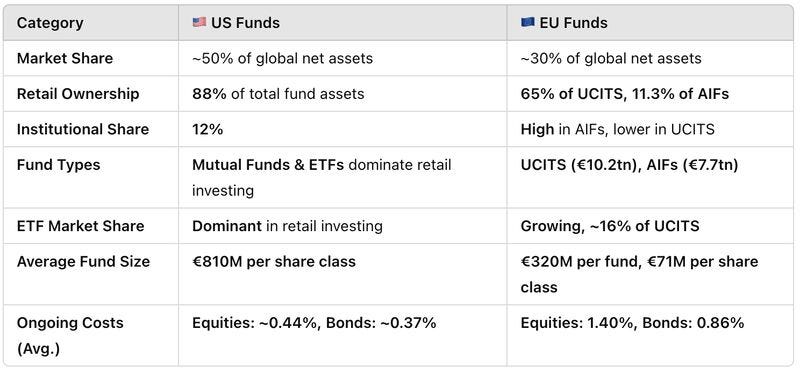

✅ US funds dominate globally – 50% of global fund assets are American, while the EU holds only 30%.

✅ Retail ownership is much higher in the US – 88% of US mutual fund assets belong to retail investors, whereas in the EU, only 65% of UCITS and 11.3% of AIFs are retail-held.

✅ Fund sizes matter – The average US fund share class holds €810M, compared to just €71M per share class in the EU. Economies of scale drive costs down in the US, but fragmentation keeps EU funds inefficient.

✅ Fees in Europe remain sky-high – Average expense ratios in the US are around 0.44% for equities and 0.37% for bonds, while EU funds charge a painful 1.40% for equities and 0.86% for bonds.

✅ ETF adoption lags in the EU – While ETFs dominate in the US, making passive investing cheap and accessible, they still account for only 16% of UCITS in Europe.

Poor Returns & Broken Pension Systems

Lower fund sizes and higher fees directly hurt European savers. Take two investors: one in the US and one in the EU, both investing €10,000 over 10 years.

The US investor would pay around €400 in fees and walk away with €15,100 after a decade.

The EU investor, facing higher fees, would pay nearly €2,000 and end up with just €12,000 after inflation.

That’s a €3,000 penalty simply for investing in Europe.

Meanwhile, most European pension systems are broken. With aging populations and unsustainable public finances, the ability for individuals to build private retirement savings is more crucial than ever. Yet, expensive, inefficient markets make this harder than it should be.

The Fix: Bigger, Cheaper, and Simpler Markets

To close this gap, the EU needs bold reforms. Here’s what would help:

✅ Larger funds & economies of scale – Encourage cross-border fund consolidation, remove barriers to institutional investment, and push forward the EU Capital Markets Union to streamline fund offerings.

✅ Educate & promote passive investing – Too many European investors are still overpaying for actively managed funds pushed by bank advisors earning commissions. Financial literacy campaigns and better incentives for passive investing are essential. ✅ Improve fund distribution – The US benefits from 401(k)-style direct investment options, bypassing banks and middlemen. The EU needs similar direct-to-investor models to lower costs.

✅ Slash regulatory burdens – EU fund disclosures and compliance costs are far higher than in the US. Simplifying fund passporting, distribution, and taxation rules could lower fees for investors.

Time for Change

The data is clear: Europe needs to close the investment gap with the US. The EU has world-class companies and a growing retail investment base, but it is held back by fragmented markets, unnecessary costs and bureaucracy, and inefficient distribution.

If policymakers don’t act, European investors will continue losing out while their US counterparts build long-term wealth faster and cheaper. It’s time to fix this system.

🔗 Read the full ESMA report here: https://www.esma.europa.eu/sites/default/files/2025-01/ESMA50-524821-3525_ESMA_Market_Report_-_Costs_and_Performance_of_EU_Retail_Investment_Products.pdf