A Transatlantic Gap: How EU Rules Foster Banking Access for Crypto and Fintech vs. Operation Chokepoint 2.0

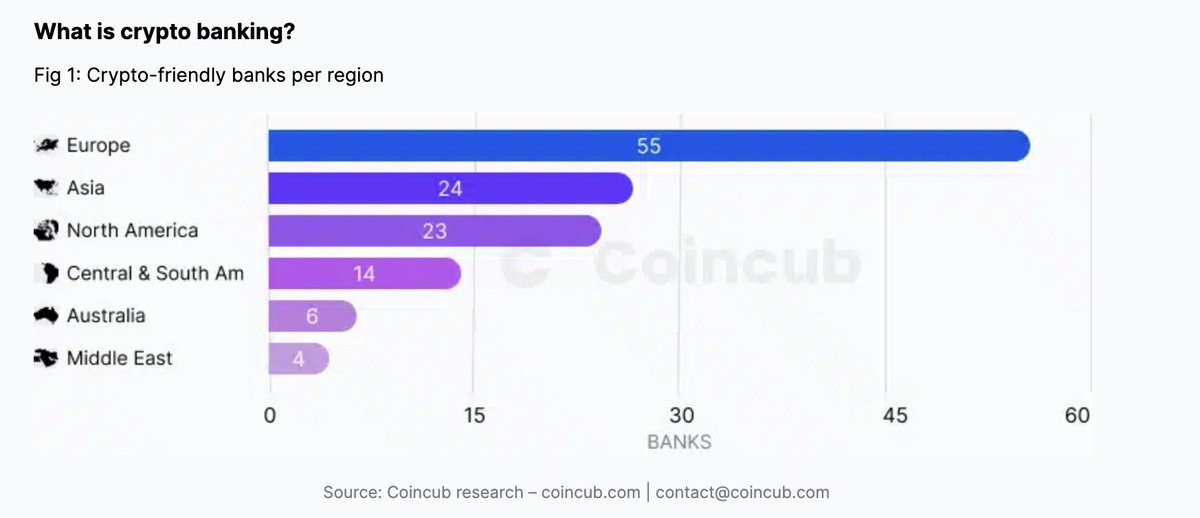

The transatlantic divide in banking access for crypto firms is striking. While many U.S. crypto companies have been left scrambling to secure banking partnerships amidst what Nic Carter has termed “Operation Chokepoint 2.0”, Europe boasts the highest number of crypto-friendly banks in the world—55 compared to 23 in North America, according to Coincub.

Why is that?

It is not because European banks are more risk-taking or innovative, but rather because EU regulations in payments and crypto are creating legal clarity, and, importantly, actively encouraging, not curtailing, competition and innovation in payments. It is because non-banks have been allowed to provide e-money and payments services and are seen as an integral building block to preserve innovation and competition in finance.

While the U.S. lacks a federal framework for payments or e-money services (regulated at the state level), the EU first introduced its E-Money Directive (EMD) in the year 2000 – almost 25 years ago. Ahead of the curve, the EU’s goal was to

“ensure fair competition among a wider range of institutions” (EMD recital 12) and avoid “hampering technological innovation” (EMD recital 5).

This was further strengthened through the introduction of the Payment Services Directive (PSD) in 2007 that includes explicit language emphasizing the need to foster competition amongst payment service providers. Crucially, the reviewed PSD2 also includes language that encourages banks to open accounts for non-bank PSPs:

“Member States shall ensure that payment institutions have access to credit institutions’ payment accounts services on an objective, non-discriminatory and proportionate basis. Such access shall be sufficiently extensive as to allow payment institutions to provide payment services in an unhindered and efficient manner.

The credit institution shall provide the competent authority with duly motivated reasons for any rejection” (PSD2 Article 36).”

Fast forward to today, the EU Commission plans to go even further, proposing to allow non-bank PSPs to both access central bank payment systems (like SEPA) directly, and also safeguard consumer funds directly with central banks:

“Considering the difficulties experienced by payment institutions in opening and maintaining payment accounts with credit institutions, it is necessary to provide for an additional option for the safeguarding of users’ funds, namely the possibility to hold those funds at a central bank” (EU Commission PSD3 proposal, recital 31).”

While it remains to be seen whether the safeguarding provision proposed by the EU Commission will survive the legislative process, the access to central bank payment systems has already been enshrined into EU law through the recently passed Instant Payments Regulation (IPR).

This has prompted the European Central Bank to publish its new

“Eurosystem policy on access by non-bank payment service providers to its central bank payment systems,” highlighting that the “broader access criteria for TARGET are aimed at enhancing the efficiency of the European retail payments market, fostering competition and innovation in the European payments landscape.”

Starting next year, I predict we will see several non-bank PSPs, including stablecoin issuers, settling SEPA payments directly through their respective central bank.

The Markets in Crypto Assets (MiCA) Regulation entering into application this year is only the logical continuation of this regulatory approach, highlighting as one of its objectives that a

“clear framework should enable crypto-asset service providers to scale up their businesses on a cross-border basis and facilitate their access to banking services to enable them to run their activities smoothly” (MiCA recital 6).”

Hence, several EU regulatory frameworks throughout the last 20 years have allowed the creation of EU-wide non-bank e-money and payment institutions, have legally enshrined their right to a non-discriminatory access to banking, have created legal clarity for crypto-asset services, and have even opened up direct access to central bank payment systems to non-banks, including stablecoin issuers regulated as E-Money Institution such as Circle in France.

It is therefore hardly a surprise that Europe’s banks seem to be more open towards regulated crypto firms. Rather, it is the result of an ongoing, +20 years old regulatory push to create clarity, competition and innovation in the EU financial landscape.

Some EU member countries have even gone beyond that. In Lithuania for example, today the majority of licensed non-bank EMIs are safeguarding customers' funds with the local central bank, the Bank of Lithuania. In France, regulated non-bank PSPs, including EMIs issuing e-money tokens, are granted a legal right to bank accounts that can, as ultima ratio, be enforced by administrative appeal, ensuring that these firms can access essential banking infrastructure.

While overregulation undoubtedly represents a real risk for the larger EU as recently highlighted by French President Emmanuel Macron or Former ECB President Mario Draghi in his EU competitiveness report, one should give credit where credit is due.

Through multiple three or four letter acronyms in the last two decades, from the EMD, the PSD, the IPR to now MiCA, the EU has not only created EU-wide legal clarity for crypto that is still lacking at a federal level in the U.S., but also ensured that banks cannot arbitrarily cut off competition from fintechs or crypto firms.

+++

Any views and opinions expressed are strictly personal and do not necessarily represent the views of my employer. This article does not constitute legal or financial advice.

Twitter: @paddi_hansen

Is there a list of crypto friendly banks? Checked Coincub link but they don't seem to share